National Insurance

The rate at which you pay National Insurance is determined by what Letter you are on. Everyone, with the exception of those who have reached state pension age, will pay National Insurance Contributions on any income over £1,048 a month.

On payments claimed from Wednesday 24th September 2025, you will pay National Insurance Contributions on any income over £242 a week unless you are of state pension age.

National Insurance Contributions are calculated per pay period and do not average out over the year for anyone.

Therefore if you do not claim one week and subsequently have multiple weeks’ worth of payments paid together, you will pay more National Insurance and this will not be refunded at a later date.

Further information on National Insurance can be found .

Tax

It’s important to know and understand what your tax code is.

The tax code that is being applied to calculate the tax that you pay on your earnings, is confirmed on your .

New starter

If you have recently accepted a new booking contract, to ensure you are placed on the correct tax code it’s important to submit your most recent P45 to ÃÛÑ¿´«Ã½ Payroll via Email.

If you don’t have a P45, or your P45 is from the previous tax year, you can complete a  and send it to ÃÛÑ¿´«Ã½ Payroll via Email.

Tax codes

There are two types of tax code; cumulative and Week 1/ Month 1.

- Cumulative tax codes work out your tax based on everything you've been paid since the start of the tax year. It spreads your tax-free allowance evenly over the year and adjusts your tax if you've paid too much or too little in total.

- If you have a Week 1/Month 1 tax code (usually ending in ‘W1’, ‘M1’ or ‘X’ e.g. 1257L X), then payments will be taxed as if it was the first week or month of the financial year, without taking into account the taxable income received, or tax already deducted earlier in the tax year.

To check your tax code:

As your payments are subject to tax deductions, it is important that you are aware of the tax code that you have been put on, as this will affect the amount of tax deducted. There are two ways that you can confirm your tax code.

To ensure you are placed on the correct tax code, ensure that one of the below is completed before the weekly cut off of your first payment to give Payroll enough time to process.

- Send a copy of your most recent P45 to ÃÛÑ¿´«Ã½ Payroll via Email.

- Complete a New Starter Checklist and send to ÃÛÑ¿´«Ã½ Payroll via Email.

Two types of tax codes

- Cumulative

- Week 1/ Month 1

- Cumulative tax codes work out your tax based on everything you've been paid since the start of the tax year. It spreads your tax-free allowance evenly over the year and adjusts your tax if you've paid too much or too little in total.

- Week 1/Month 1 tax code (usually ending in ‘W1’, ‘M1’ or ‘X’ e.g. 1257L X), then payments will be taxed as if it was the first week or month of the financial year, without taking into account the taxable income received or tax already deducted earlier in the tax year.

Transitioning to weekly payroll

Currently ÃÛÑ¿´«Ã½ Freelancers are paid monthly. Therefore the current standard tax code of 1257L would mean a monthly tax free allowance of £1,048 per month.

However when the weekly payroll commences, the standard tax code of 1257L would mean a weekly tax free allowance of £242 per week.

If you are on a cumulative tax code, and forget to accept a booking until near the end of the booking, then it may not make much difference to what tax you pay because you will have accumulated several weeks’ worth of tax allowance since your start date.

But if you have several weeks’ worth of pay paid in one go, and are on a Week 1/Month 1 tax code, then only one week of tax allowance will be applied to that income, and if you are on the standard tax allowance of 1257L X then only £243 of that income will be tax free. And if you remain on a Week 1/Month 1 tax code for the rest of the tax year, then you may only receive a refund of any overpaid tax once the tax office has reviewed your total taxable income at the end of the tax year.

The thresholds for paying higher tax rate, additional tax rate (or intermediate, higher, advanced and top rax rate if you live in Scotland) will also will also be applied on a weekly basis too.

The rates and thresholds are on the .

Student Loan

The threshold at which you pay Student Loan, if you have one, depends on what plan you are on; 1,2 or 4 or if it is a postgraduate loan.

| Rate or threshold | 2025 to 2026 rate |

| Plan 1

|

£26,065 per year £2,172.08 per month £501.25 per week |

| Plan 2 | £28,470 per year £2,372.50 per month £547.50 per week |

|

Plan 4 |

£32,745 per year £2,728.75 per month £629.71 per week |

|

Postgraduate loan |

£21,000 per year £1,750 per month £403.84 per week |

9% of earnings over the relevant threshold will be deducted for Student Loan and 6% for postgraduate loans.

Student Loan deductions are assessed based on an individual pay period and are not averaged out over the year. However if by the end of the tax year, you have not earnt over the annual threshold overall, then you may apply directly to the Student Loan company for a refund if you wish.

Further information on Student Loan deductions can be found .

P45/P60's

To request a P45 be generated for yourself, please . The team will then process a P45 request, and a P45 will be available to you on the last working day of the month.

P45's prior to July 2024 will be available on ÃÛÑ¿´«Ã½ .

P45's from July 2024 will be available on .

Please note that one month after your last ÃÛÑ¿´«Ã½ engagement ends, you will be automatically withdrawn from our system, for Data Protection and Compliance reasons. At this point, a P45 will automatically be generated for you.

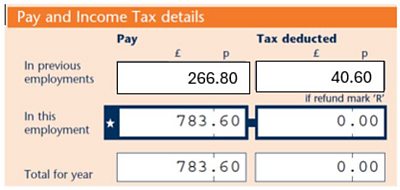

As a freelancer, you may have multiple bookings in a financial year.

You may start one booking for 3 weeks, and after 3 weeks you will be made a leaver on our system, before your next booking starts.

At the end of your booking you will be issued with a P45, which you should hand to the next organisation you are contracted with, even if this is the ÃÛÑ¿´«Ã½. If you are contracted with another organisation then hand them the P45; then if you return to the ÃÛÑ¿´«Ã½, hand the P45 you receive from them to ÃÛÑ¿´«Ã½ Payroll.

What happens if you do not hand in a P45?

- Your tax may not be calculated correctly.

- Your P60 will not include the previous earnings

When do I get a P60?

- P60’s are only issued to individuals still in contract on 5th April.

- If your contract finished before this date, you would not receive a P60.

Currently, for the 2023-2024 tax year we are able to provide a ‘leavers’ P60. This means for each contract you work; you will have a P60 for that work. This is not normal practice, as P60’s should not be given unless in contract on 5th April, and then this should only be for the last contract worked.

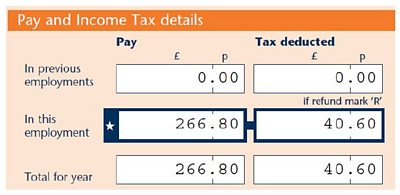

What does this look like?

On the P60, you will have the following details:

If you do not hand in a P45, currently you will receive multiple P60’s which you will need to total together for your earnings for the financial year.