How does money work in prison?

There are 98,000 people in prison across the UK. Although their meals are provided and there's obviously no rent or mortgage to pay, they still need to handle cash, budget for essentials and open bank accounts.

In fact, there's reason to think that financial security reduces reoffending and helps prisoners to rehabilitate.

For a special episode of ÃÛÑ¿´«Ã½ Radio 4's Money Box Live, Felicity Hannah and producer Sarah Rogers were given access to a residential centre in Preston run by the charity Recycling Lives. It takes a small number of ex-offenders and gives them a place to stay, training and support getting into work. Reoffending rates are far below the national average.

Former prisoners, prison volunteers and experts explained how money works behind bars – and why it should matter to all of us.

They get 'bang-up' pay and can earn wages

“If you haven’t got a job, you’re on £2.50 bang-up pay,” explained Matty, who is now being supported through Recycling Lives following prison time for offences including shoplifting and burglary. “You need money in jail, you do need money. Some jobs pay different; if you’re a wing cleaner you get £10 a week. If you’re in a workshop you might get £15 a week.”

Prisoners earnings can vary across the UK, across different prisons and even within them. As Matty worked in a Recycling Lives workshop in prison, he received £15 a week to spend and £40 paid into a savings account.

Pay for prisoners went up this year by £1 a week – that’s the first increase in a decade.

“My partner receives 50p 'bang-up' pay a day and the wages for either the job or education he is accessing, roughly £11 (I know it varies across prison),” said one listener who emailed Money Box Live.

“From this he buys phone credit and canteen. Calls are expensive and phone line is better than mobile. When wages don't come through he can't phone or get canteen. Family do what we can so we can stay in contact.”

‘Canteen’ in prison refers to the groceries they are able to buy separate to the meals provided.

Many prisoners start in debt

Although it varies between prisons and across the UK, prisoners will usually be given a pack of essentials on arrival. In Matty’s prison, the cost was £20.

It can be known as a reception pack, comfort pack or first night pack and may include tea, milk and toiletries. Official guidance is that prisoners should be told that the cost of the pack will be recovered from their future earnings and that they can refuse to accept it if they don’t want to repay that.

As well as that official debt, some prisoners borrow money from each other. “A lot of people get into debt in prison because they’re borrowing things and they can’t pay it back,” Matty said. “And that’s where the violence comes in.”

The Ministry of Justice told Money Box Live that “debt fuels violence in prisons” and that’s why it “offers a range of support to prisoners to help them with their finances”.

Prisoners pay for phone calls, emails and TV

“You have to 50p for your electric,” Matty says. “50p for your TV. That’s if you’re in with somebody, if you’re on your own it’s £1. And then you’ve got to pay 50p for your loan, so that £2.50’s already gone.”

“Using eMates to message my partner, costs 68p,” explained one listener who did not give their name. “42p for my message and a reply sheet so he can answer, costing 26p.”

Unilink, which is the parent company of eMates, told Money Box Live that it knows how important communication is in supporting people in prison. It’s working towards changing to a subscription service in the next few months, which it says would “significantly” reduce the costs.

Money skills could cut reoffending

Many people will have little sympathy for the financial struggles faced by prisoners. However, many experts believe that improving prisoner finances could make a real difference to society.

Money is a basic foundation for rebuilding our life in these scenarios. It does support with reducing reoffending.

Ana Caldeira runs Finance, Benefit and Debt Services at the charity Catch 22, which provides money advice and support to ex-offenders. She told the programme: “Money is a basic foundation for rebuilding our life in these scenarios. It does support with reducing reoffending and that’s something we always need to have at the back of our minds.

“What skills are we building whilst they’re in prison to build on their finances? We are building foundations of how to budget, how to maximise your income. Whether it’s maintaining employment, which is a massive factor when they are reintegrating back into society. All these are skills they are learning.”

The latest data from England and Wales shows a reoffending rate of more than 26 per cent, while for people released after serving less than a year it’s almost 57 per cent. Reoffending doesn’t just create new victims, there’s also a huge cost of £18bn a year, according to the government.

Banks do more than before

Many prisoners don’t have bank accounts or lose them due to inactivity. Having an account open on release is vital for receiving benefits and securing accommodation.

The Prisoner Banking Programme helps prisoners to open a basic bank account before their release and many of the main UK banks are signed up to provide these accounts. According to the Prison Service, 10,000 accounts were opened under this scheme in the last year alone.

However, not every prison is signed up to the scheme and not every prisoner who tries is successful.

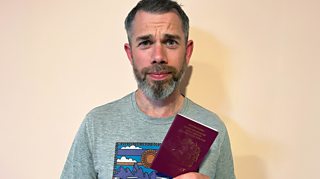

“I keep getting refused, because I don’t have enough identification,” Lee told Money Box Live. He went to prison after failing to stop when police tried to pull him over on the road and then failing to turn up at court, and he has recently been released.

“All you get on release is your licence, which has your photo, your prison number and where you’ve got to go. That’s all you leave prison with. Being in hostels you don’t have proof of address or previous addresses… I’m currently in a hostel and then homeless. Trying to look into private renting but when you have no ID or bank account it’s impossible to do anything.”

UK Finance, which represents the banks urged prison leavers to apply for a basic account. A spokesperson said: “If it has not been possible to open an account before being released, people can apply for a basic bank account. The nine largest banks are required to offer these and HM Treasury’s most recent statistics show that over seven million of these have been opened.”

Insurance can be difficult

Being able to take out insurance can be essential for normal life, whether it’s car, home, travel or other policies. However, insurers don’t have to accept every applicant and having a criminal record can make it extremely hard for both the prison leaver and their family.

“My husband spent three and a half years in prison for fraud offences,” one anonymous email to the programme explained. “I didn’t expect the ongoing financial consequences of having someone in the family with a conviction. It has been really hard to find insurance for the house, car and travel, even if I arrange the contract and it’s on my assets and in my name.

“At the moment a car is essential for his work and family life so we've had to accept very high premiums from a diminishing number of providers. Without travel insurance, we can't risk a family holiday – the fallout from a serious health issue could finish me off financially. But the biggest worry is house insurance. Over the years, I've had to move insurers a number of times when new clauses excluding him are added to their terms.”

To hear more about finances in prison and on release, listen to Money Box Live: Behind Bars on ÃÛÑ¿´«Ã½ Sounds now.

The information in this article was correct at the time of broadcast on 2 July, 2025.

More from ÃÛÑ¿´«Ã½ Radio 4

-

![]()

Your travel money nightmares

From torn passports to insurers not paying, how much does travel disruption cost?

-

![]()

'I gave my kids £300 to see what they would do with it'

From pocket money to savings accounts, we look at the world of children's finances.

-

![]()

Seven things you need to know about buying a house

Advice for first-time home buyers from Money Box Live.

-

![]()

Can you afford to be a foster carer?

Felicity Hannah looks at the finances of fostering.