Money Shop boss warns of 'unregulated' loans

Some customers have moved from a regulated to an unregulated part of the industry, says The Money Shop Chief Executive Stuart Howard.

Short-term lenders are warning that people who need to borrow money are at risk of falling into the hands of loan sharks because of tougher regulations imposed on their industry.

Short-term lending has been cut by 68% in two years as regulators imposed price caps, the Consumer Finance Association (CFA) said.

In a report to MPs, the trade body said that 80% of loan applications were rejected.

Of these, 4% have borrowed from illegal lenders instead, the CFA claimed.

“We’ve seen the volume of customers decrease,” said Stuart Howard, chief executive of The Money Shop.

He said The Money Shop had altered their business model and moved away from payday-focused 28-day loans to loans with a 3-4 month repayment period.

Mr Howard explained that “people are modifying their behaviour” in response to both this change and the CFA’s affordability checks.

"We want to build a business that’s focused on consumer credit rather than default fees," said Mr Howard.

But he said the appetite for loans had not diminished and there were undoubtedly some customers who had moved from a regulated to an unregulated part of the industry.

Duration:

This clip is from

More clips from 21/07/2015

-

![]()

Majority of listeners 'happy with digital radio'

Duration: 03:05

-

![]()

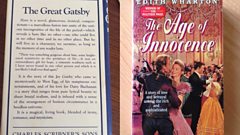

How do you choose your next read?

Duration: 05:01

More clips from Today

-

![]()

Jeremy Bowen: Chances of peace in the Middle East

Duration: 10:01

-

![]()

ChatGPT to allow erotica for verified adults - OpenAI boss

Duration: 03:09

-

![]()

Tim Curry on stardom and life after having a stroke

Duration: 04:41

-

![]()

Badenoch wants PM to address China spy case questions

Duration: 02:50